Investing – Portfolio Structure

Each investor has his own approach. In this article we would like to show how a possible portfolio for a private person could be structured.

Regardless of how your portfolio is divided, it is important that you have a strategy for minimizing risk and exploiting opportunities in the market.

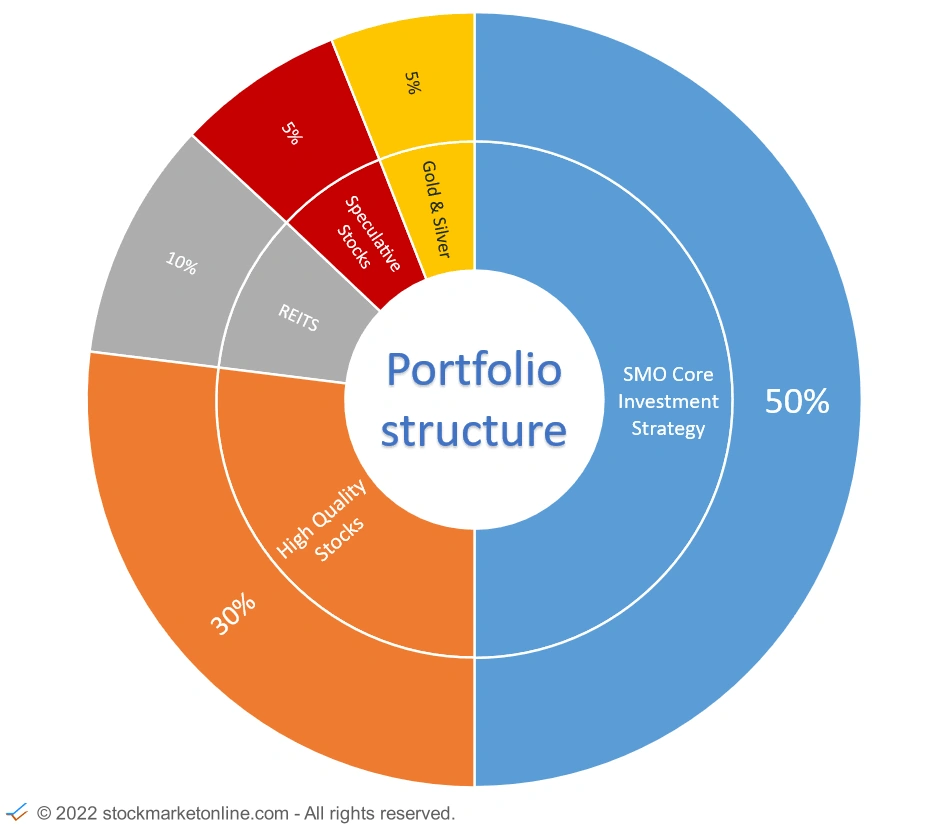

Example of a portfolio allocation

This example shows how the funds in a portfolio can be split.

The distribution of the funds is selected in such a way that a good risk - profit ratio can arise. Whether this approach works depends of course on the quality of the individual investments.

The largest part, with 50%, we see in the implementation of a broadly diversified ETF strategy. In our example, we refer to our ETF Core Investment Strategy.

.. More .. ETF Core Investment Strategy - How it works.The second largest part, with 30%, is reserved for investments in "High Quality" stocks. This part of the portfolio is used to invest specifically in individual companies that stand out due to their very good future prospects.

A further 10% of the portfolio is earmarked for real estate investments via REITS. Those who already have physical real estate in their asset structure can define this area smaller or leave it out completely.

5% of the portfolio is reserved for speculative stocks. This capital is to be invested in small emerging growth companies with incredibly good future prospects.

The remaining 5% of the portfolio is earmarked for investments in precious metals. This investment is intended to serve as insurance for the depot. In the event of major price fluctuations in the stock indices, precious metals usually develop positively. Those who do not want to invest directly in precious metals can also implement this approach with mining companies.