Seasonal Screener

Use our Seasonality Screener to automatically identify strong trading signals!

The screener offers numerous filters that you can adjust according to your needs.

Set your screening parameters and get the best results.

There are hundreds of very good entry and exit times stored in our database.

We help you find recurring patterns with annual hit rates of over 90%.

The screener offers numerous filters that you can adjust according to your needs.

Set your screening parameters and get the best results.

There are hundreds of very good entry and exit times stored in our database.

We help you find recurring patterns with annual hit rates of over 90%.

Improve your trading results by screening hundreds of instruments in all sectors, using customizable screening criteria to discover investment opportunities.

With a few clicks, you will get the best seasonal patterns.

With a few clicks, you will get the best seasonal patterns.

The screener shows you the results separately for stocks, ETFs, indices, currencies and futures.

So you always have an overview and can focus on your preferred asset class.

What should a practical analysis tool look like?

Relevant & insightful data

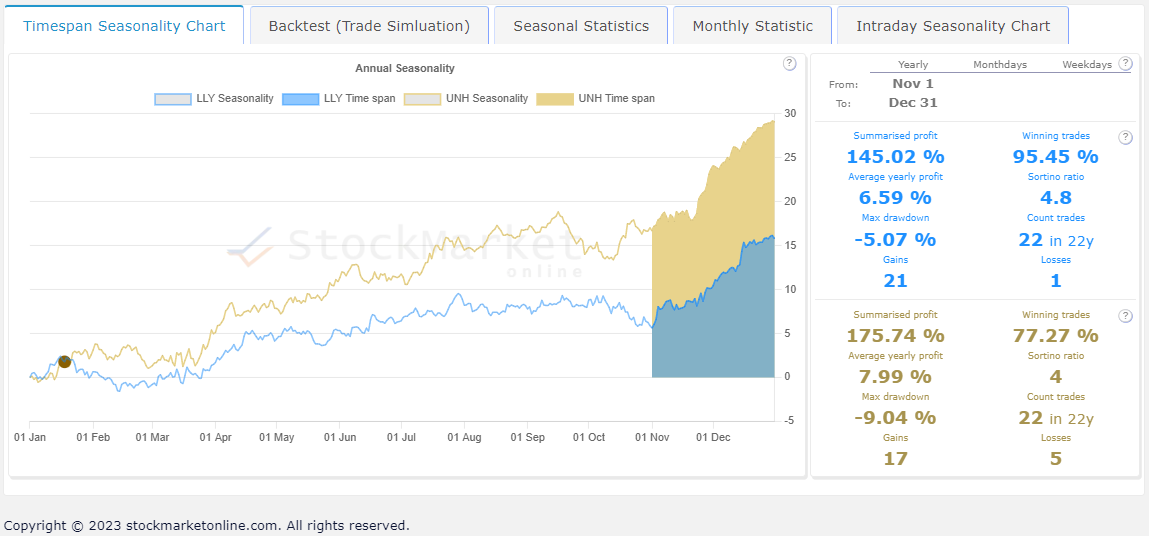

Many free analyses display 1-2 data series in a chart. This is usually helpful for a rough assessment of situations. But to make sustainable and profitable trading decisions, more insight is needed.

Content-rich data:

- Backtests show very well the "What would have been the profit if I had implemented the same action in the past?" scenario.

- Metrics quickly show the quality of the analysis's result.

- Data filter options allow you to recreate historical situations.

Speed & functionality

Time is a limiting factor for many private market participants. Most private individuals have a job, family and hobbies. There is not much time for extensive research and analysis.

Good analysis tools:

- show relevant data quickly and clearly.

- offer useful filters and configuration options.

- offer powerful screeners.

- offer comparative analysis of multiple instruments.

In a world with a lot of data, quality is more important than quantity.

Start Your Free Trial Now

USE HIGH QUALITY ANALYSIS and FIND OPPORTUNITIES WITH JUST a FEW CLICKS.

Make use of our risk-free trial.