Drawdowns vs. Recovery’s

by SMO Team

Why are impairments or price declines so critical?

The problem with price declines is the amount of price recovery that is necessary to compensate for the previous price decline.

The size of the price recovery must be much larger than the previous price decline. Large price recoveries are not easy.

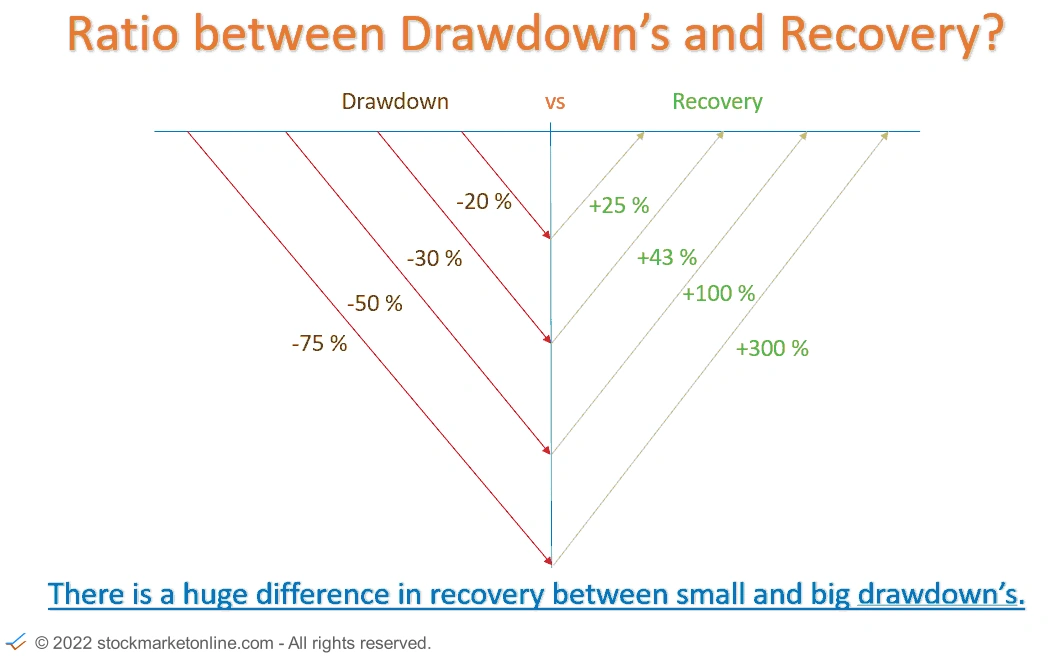

How high the recovery must be is shown in the graphs with four examples.

Difference between price decline and price recovery

The first chart uses four examples to show that the recovery must be greater than the price decline.

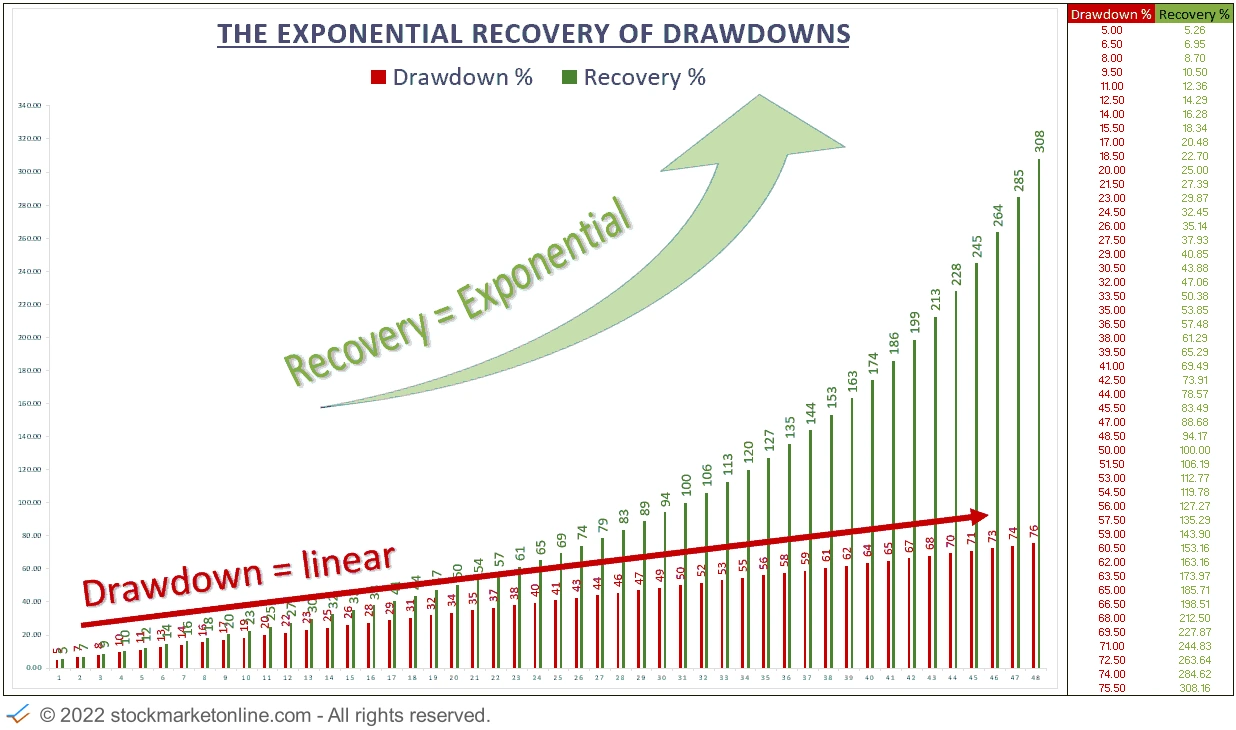

If one compares a mathematical simulation of price decline and price recovery for all values, it quickly becomes apparent that the price decline is a linear function and the price recovery is an exponential function.

From this it is easy to see the large imbalance that can exist between price declines and price recoveries.

Extremely high drawdowns require several hundred percent recoveries to get back to pre-drawdown levels.

Unrealistic simulation: S&P500 index without crises

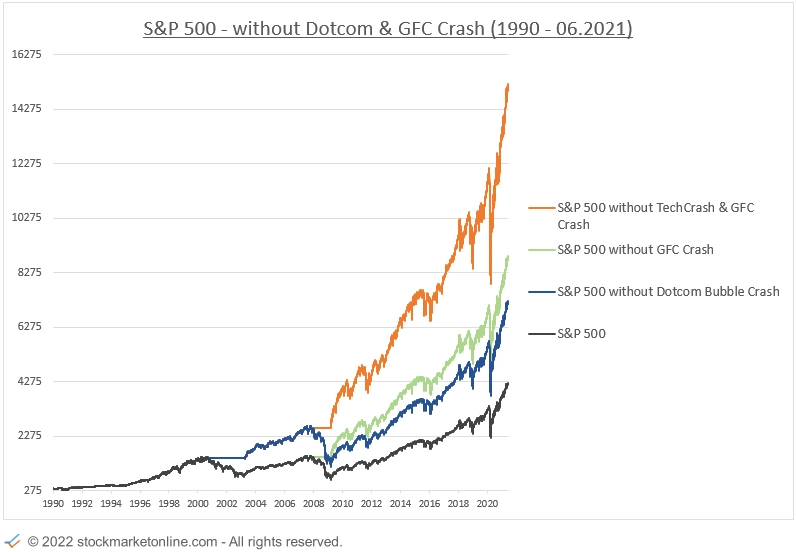

We have calculated a theoretical scenario in which the two price declines of the Dotcom Bubble and the Global Financial crisis became zero in the S&P500.

This is to show the potential to avoid strong price declines.

In practice, this scenario is unrealistic to set the price declines to zero. But with good risk management, price declines can be kept small.

Summary

Avoiding large drawdowns, generates a massive excess return.

Small drawdowns are good opportunities for investors to build positions. Stocks that have fallen sharply, on the other hand, are a tricky business. Most of the time, there are fundamental reasons why a stock price plummets. If you are thinking about investing in a stock that has fallen sharply, you should do extra research to find out how high the risk is.