Build Wealth with Investing

by SMO Team

Investing – A Good Way To Build A Wealth

An effective way to build wealth is to invest a regular savings rate. The compound interest effect develops its full potential over several years.

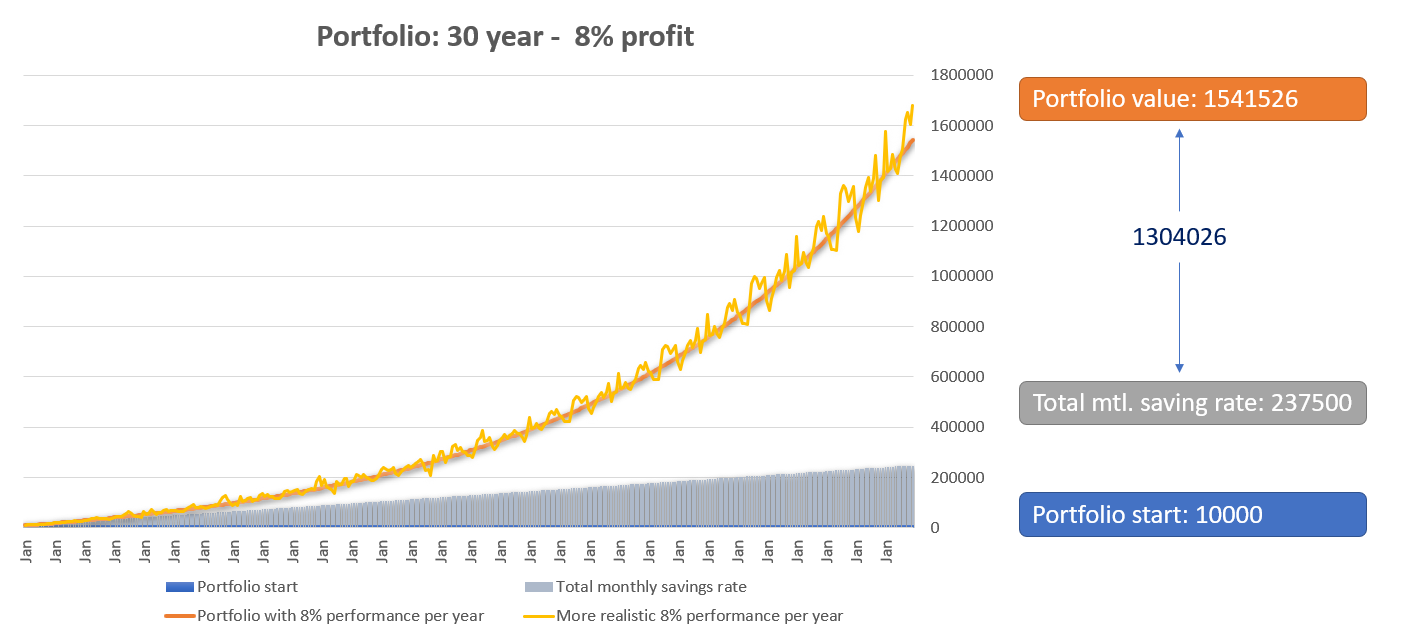

We show you an example of how a portfolio can develop if regular investments are made and a long-term performance of 8% takes place.

The analysis was performed for the periods of 3, 5, 10, 20 and 30 years.

The example is calculated very conservatively because the monthly savings rate remains the same over the entire period. For most investors, the savings rate will increase over time.

Assumption performance of +8% (stock market average) over several years:

- We start with an investment sum of 10000 USD.

- An additional 500 USD is invested every month.

- An additional 2000 USD is invested every January.

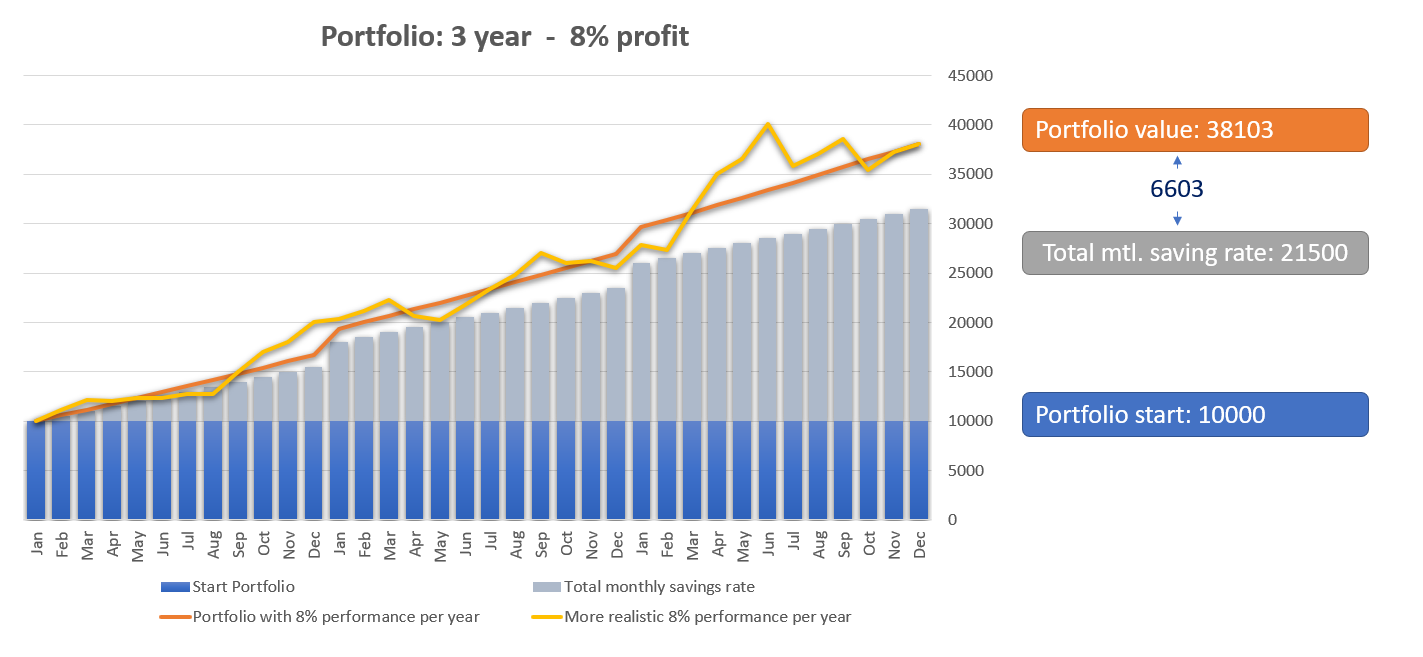

3 Year Development

Performance:

- Total Invest: 31'500 USD

- Total Value: 37'905 USD

- Total Profit: 6'405 USD

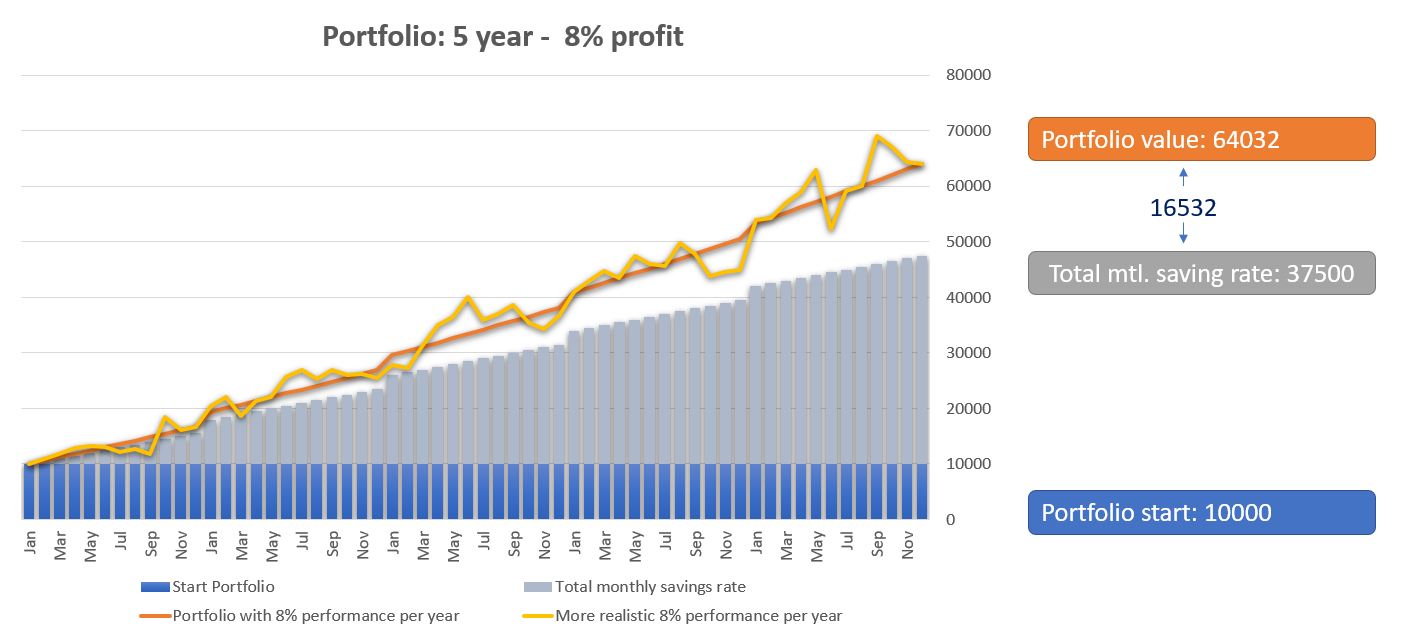

5 Year Development

Performance:

- Total Invest: 47'500 USD

- Total Value: 63'651 USD

- Total Profit: 16'151 USD

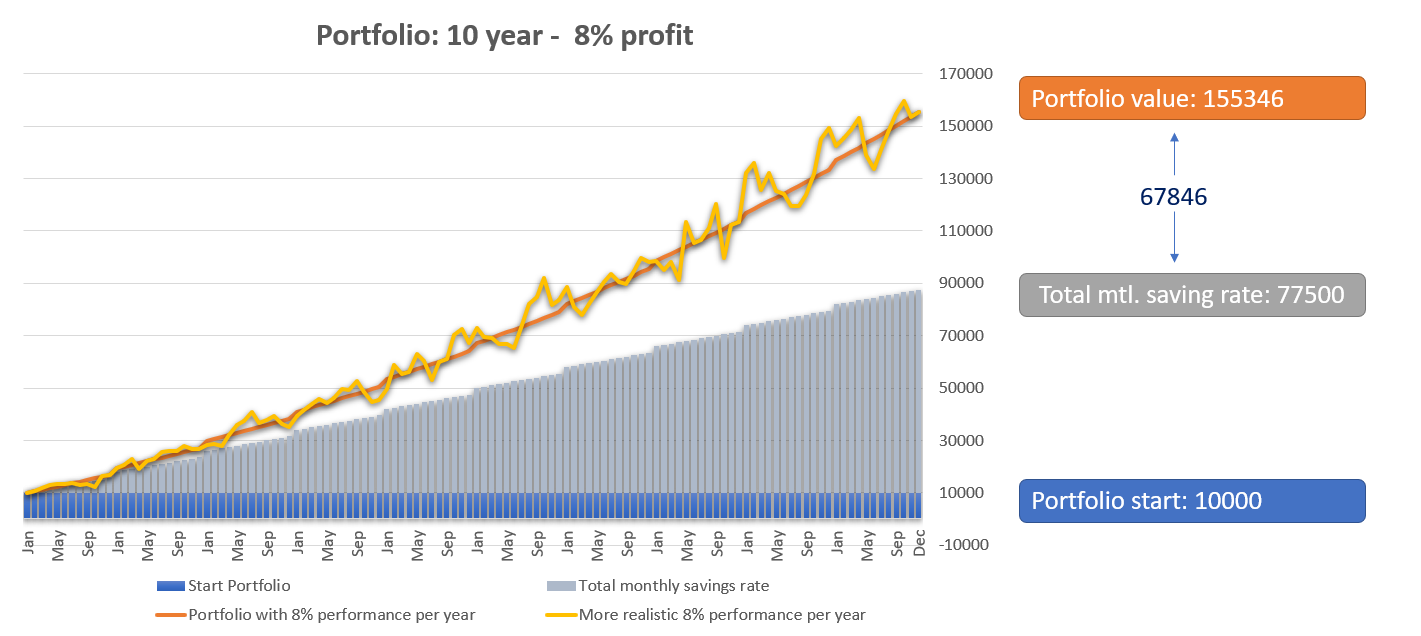

10 Year Development

Performance:

- Total Invest: 87'500 USD

- Total Value: 154'318 USD

- Total Profit: 66'818 USD

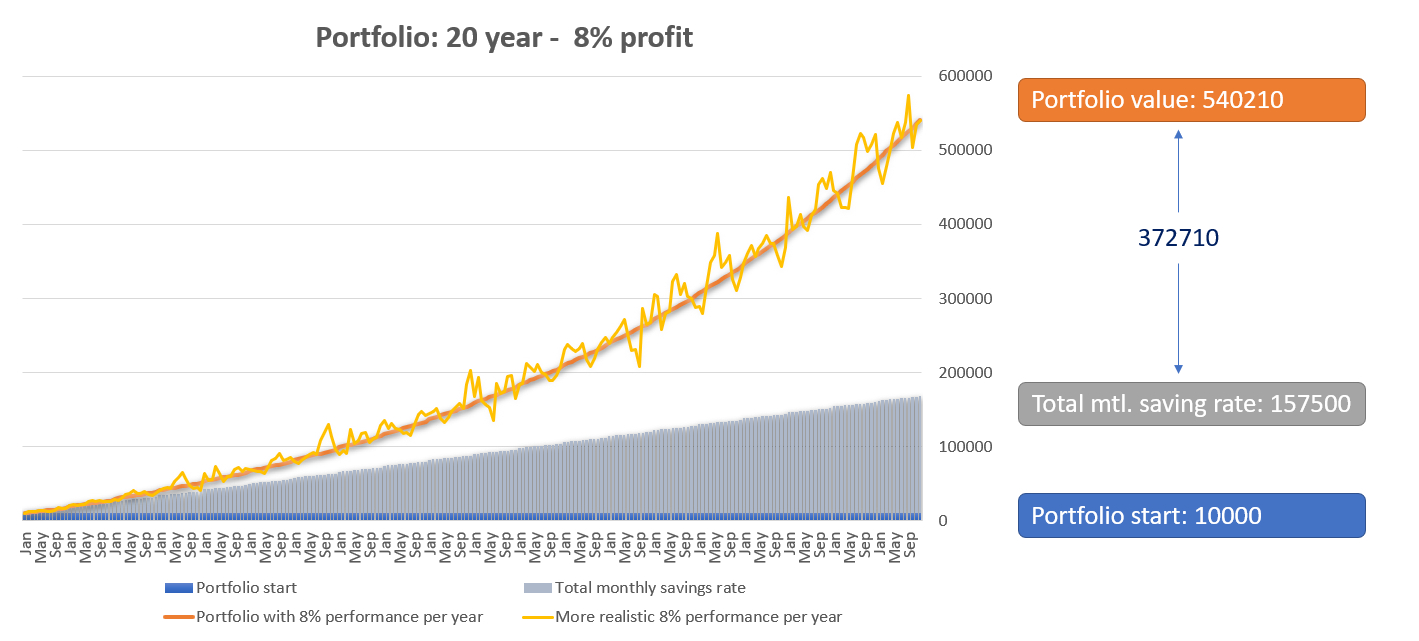

20 Year Development

Performance:

- Total Invest: 167'500 USD

- Total Value: 536'455 USD

- Total Profit: 368'955 USD

30 Year Development

Performance:

- Total Invest: 347'500 USD

- Total Value: 1'530'678 USD

- Total Profit: 1'283'179 USD

Summary

Albert Einstein called compound interest the eighth wonder of the world.

Investments benefit enormously from a long-term investment horizon.

We already know that long-term investing is not what most people want. Get rich quick is much better and in the long run we're all dead. But it's still a good option. Many retirees are very happy that their long-term investment will enable them to enjoy their retirement.

You can calculate the potential of your investment with our free investment calculator.