Best Portfolio Management Solution

by SMO Team

Disclosure: Some of the links in this article may be affiliate links, which can provide compensation to me at no cost to you if you decide to purchase a paid plan. These are products I’ve personally used and stand behind. This site is not intended to provide financial advice and is for entertainment only. You can read our affiliate disclosure in our privacy policy.

How to protect your assets from bank or broker failures? Do you have a single or multiple stock portfolios?

Are you protected from difficulties with your bank or broker? The financial crisis has shown that customers who had their stock portfolio exclusively with Lehman Bank got a big problem.

In this article, we will show you how to protect yourself from these risks and how a practical implementation is as easy as possible.

We all invest our capital in order to increase it and profit from the returns. Those who have earned their capital themselves know how long it can take to accumulate a larger sum. Each of us is happy when his capital grows and its returns increase continuously.

However, when risks materialize and the opposite of appreciation happens, it is of course even more annoying when your capital is diminished by external factors and shrinks without your intervention.

Financial crisis

The financial crisis of 2008/2009 shows how quickly this can happen and what dimensions these risks can reach.

During this period, around 100 banks went bankrupt in the USA. The Lehman Brother bankruptcy is the most prominent example. But other well-known banks such as Partners Bank, Colonial Bank from Alabama, Guaranty Bank from Texas, Hillcrest Bank, Flagship National Bank from Bradenton, First Federal Bank from Lake City, American United Bank from Lawrenceville in Georgia, Bank of Elmwood in Wisconsin, Riverview Community Bank from Otsego in Minnesota and First Dupage Bank in Illinois also failed.

Meanwhile, industry giants such as Citigroup and Bank of America survived with billions in aid from the U.S. government.

If you have your money at only one financial institution, you run a high cluster risk.

If you depend on the income and dividend payments of your shares, it is imperative that you spread your securities account over several banks or brokers. If the financial institution should really fail, the dividend payments will be cancelled for a long time. It may be a long period of time before you can access your capital again. If you have cash amounts higher than $100,000 in your account, the amounts higher than $100,000 may not be refunded in case of bank insolvency.

Diversification

If you want to minimize risks, you have to diversify your portfolio and the location of the capital.

For most investors, diversification is nothing new. But practice shows that often only the individual stocks in the portfolio are diversified. The bank or broker default risk is usually ignored.

To minimize this risk, you don't have to find the one best bank or broker, but you have to find the best three or best five banks or brokers.

That sounds like a bit of work. And yes, investing can be easy, but if you want to do it professionally, you need to put in a little more work. Remember, it always pays to avoid risk with a good sense of proportion. As briefly described earlier, the past has shown that risks can become a reality in difficult times.

Diversification guidelines

Spreading one's capital over several accounts reduces the risk of bank or broker failure.

It is up to each person to decide how much diversification to implement.

Basically, the following rules can be applied.

- From $200,000 the deposit should be split between two banks/brokers.

- From $500,000 the deposit should be split between three to four banks/brokers.

- Cash holdings should not exceed $100,000.00 per bank/broker. Up to this amount, cash holdings are protected by insurance for each customer by default. Higher cash amounts could be lost in the event of bank insolvency.

Practical implementation with StockRover

Anyone who has diversified their share portfolio across several financial institutions can quickly lose track of everything.

But there is a perfect solution for this problem, which brings even more benefits.

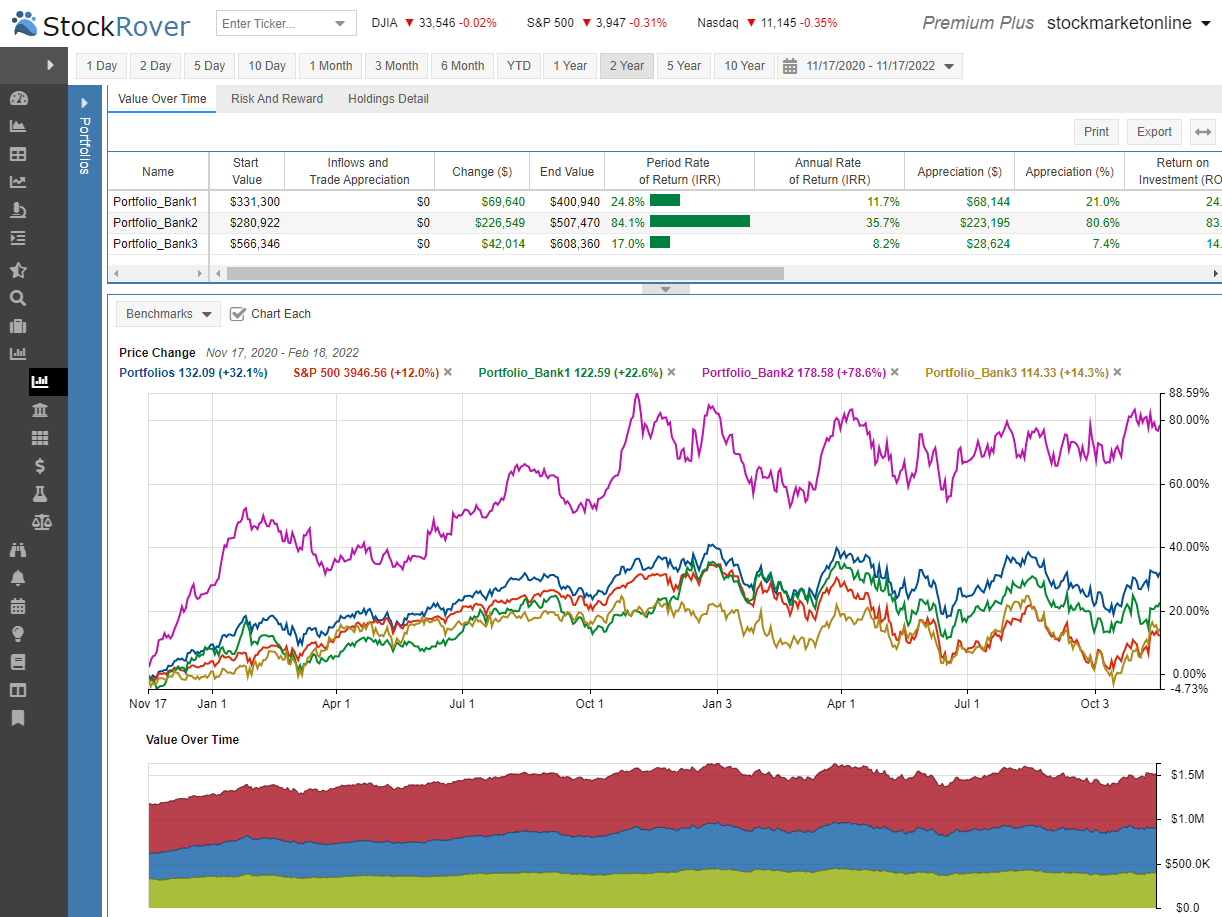

StockRover offers a platform in which several stock portfolios can be queried and displayed together. The analysis of the entire portfolio can be done with just a few clicks.

The individual share portfolios are read out by their bank or broker. There are no functions for opening positions, which we find very good. Thus, it is a pure read connection and thus offers higher security.

StockRover's brokerage integration allows you to access all possible banks and broker accounts with your account data. Thereby banks and brokers like:

- Charles Schwab

- Fidelity

- Morgan Stanley

- E*Trade

- T.Rowe

- TD Ameritrade

- Interactivebrokers

- Wells Fargo

and many more available.

Portfolio Reporting

With StockRover Research Reporting Service you can get interesting information from over 7000 stocks.

In the detailed analysis, different key figures can be created for different time periods.

The most frequently used key figures are the absolute return, the

- Absolute return

- Volatility

- Beta

- Sharpe Ratio

and many more can be evaluated.

Of course, these key figures can also be created for individual positions.

Future Income

Future Portfolio Performance Simulation

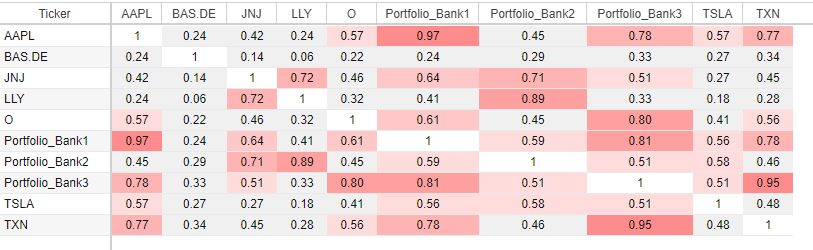

Correlation matrix

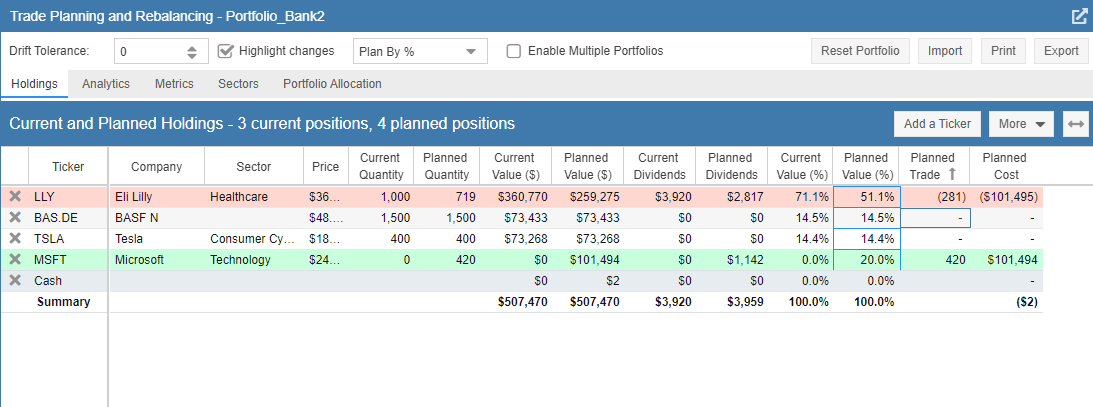

Trade Planning and Rebalancing

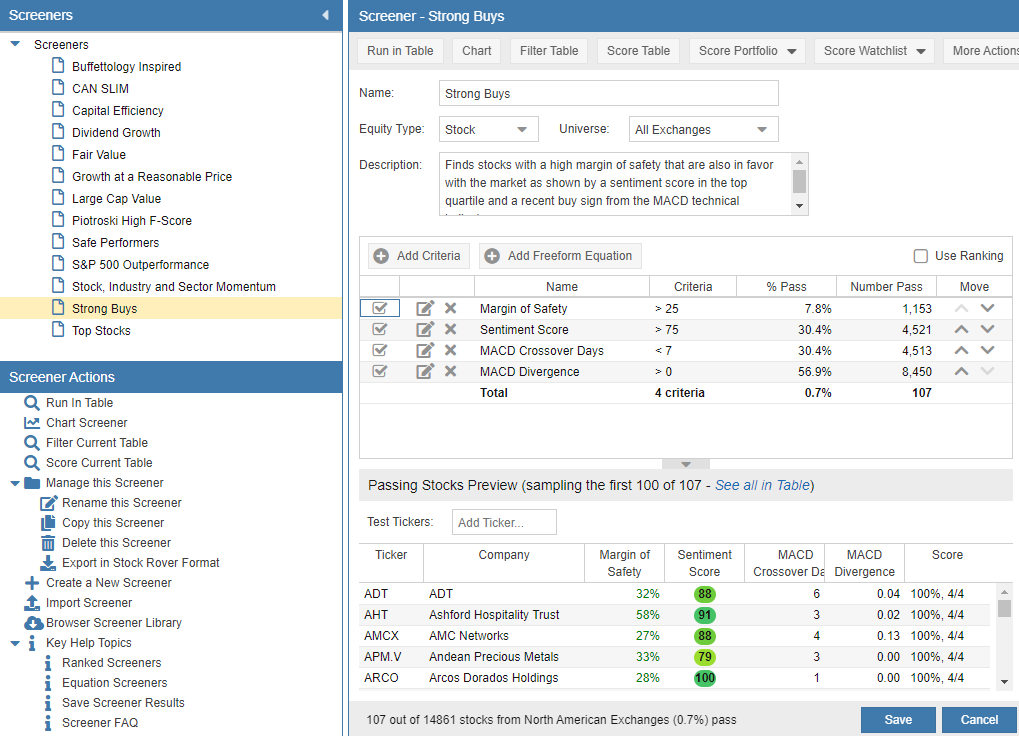

Powerful Stock Screener

Alerting

Reporting

Solution

Summary

Two points are most important when investing money. In the first place is asset protection. In second place is wealth accumulation.

Those who do not protect themselves from risks may not be aware of the problems of past crises. Risks do not materialize every day. Just because everything goes well for years, you should not ignore dangers.

In practice, this means:

- Spread your assets across multiple banks and brokers

- Keep track of your assets with solutions like StockRover's

Don't forget the number one rule of wealth management!

Do not lose money!

Disclosure: Some of the links in this article may be affiliate links, which can provide compensation to me at no cost to you if you decide to purchase a paid plan. These are products I’ve personally used and stand behind. This site is not intended to provide financial advice and is for entertainment only. You can read our affiliate disclosure in our privacy policy.