72 Rule - Money Management

by SMO Team

Money Management - 72 Rule

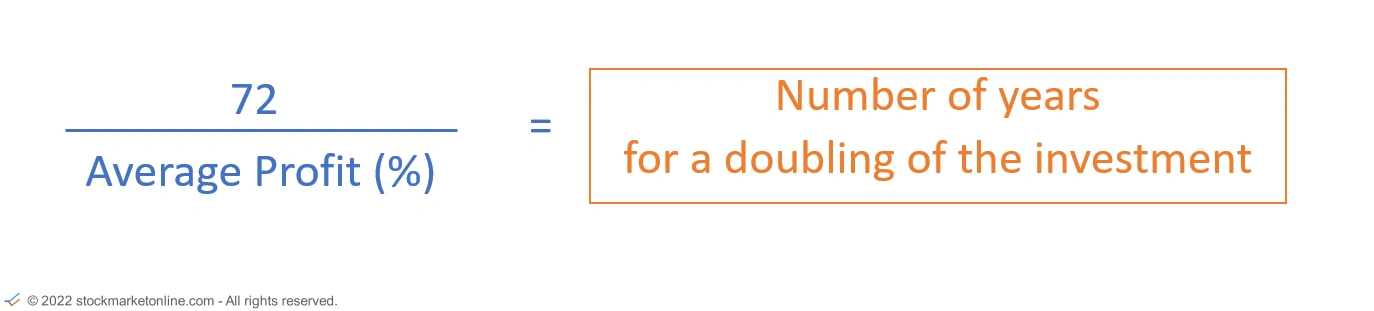

The 72 Rule is a simple tool to determine how many years it takes to double one's capital at a positive rate of return.

72-Rule

The 72 Rule is a simple tool to determine how many years it takes to double one's capital at a positive rate of return.

To do this, divide 72 by the average positive performance and get the number of years until the investment doubles.

72-Rule Samples

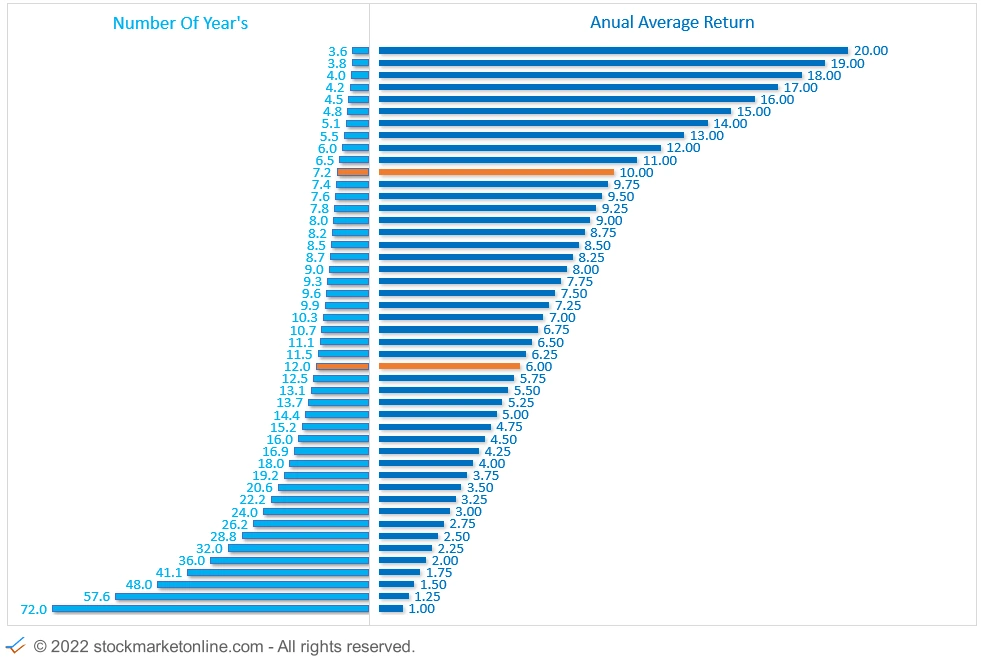

The following table shows the relationship between the number of years and the average return.

| Average Annual Return | Number Of Years To Double The Investment |

| 3.00 % | 24 |

| 4.00 % | 18 |

| 5.00 % | 14.4 |

| 6.00 % | 12 |

| 7.00 % | 10.3 |

| 8.00 % | 9 |

| 10.00 % | 7.2 |

| 12.00 % | 6 |

| 18.00 % | 4 |

Summary

Use the 72 rule to easily see how much potential lies in your investment.

In such an assessment, you should always take into account the real interest rate and inflation. If the average return on your investment is permanently lower than inflation, you will lose money.

You can calculate the potential of your investment with our free investment calculator.